The companies transforming insurance for good, through technology

Two insurtech start-ups have very different offerings but one clear mission: to disrupt and transform the insurance industry through technology. Candice Krieger finds out more

Insurance is one of the largest industries in the UK yet it has hardly changed in 200 years. The sector, typically slow to adapt to socioeconomic shifts, is being challenged more than ever by the changing needs of workers, combined with the acceleration of the digital world. Insurtech (tech advances in the field of insurance) is

a rapidly growing phenomenon. According to reports, the global market revenue for this year (2019) is valued at $5.48 billion (£4.12bn) and forecast to reach $10.14bn (£7.63bn) by 2025 – a compound annual growth rate of 10.80 percent.

Two companies already influencing and disrupting the market are Collective Benefits, founded by Anthony Beilin and Benjamin Hay, and Sammy Rubin’s YuLife.

Sammy Rubin, founder of YuLife

Get The Jewish News Daily Edition by email and never miss our top stories Free Sign Up

It’s a time-worn adage that money can’t buy you happiness. And serial entrepreneur Sammy Rubin has experienced it first-hand.

Rubin, who founded and floated his first business in his twenties – and was the youngest director of a publicly-listed financial services company – is today the founder of YuLife – a revolutionary award-winning insurance company with well-being at its core. He was inspired to set it up after embarking on his own spiritual journey and realising the importance of prioritising well-being over material success.

Tech-driven YuLife aims to encourage positive lifestyle changes in its users by rewarding healthy living, and turn financial products into a force for good. Rubin says: “I had sold my first company and had achieved a lot, but something wasn’t working. I had material success, but was unfulfilled. I felt there was something more I needed to discover.”

The entrepreneur took a six-month sabbatical, travelling from New York to Safed, Israel, learning yoga, meditation and deepening his understanding of spirituality. Motivated to do something more meaningful with his life and career, and inspired by the Jewish concept of tikkun olam (repairing the world), Rubin returned to the UK with a fresh outlook. He became the founding CEO of VitalityLife (formerly PruProtect), the first life insurance company in the UK to reward healthy behaviour.

But he saw an opportunity for a new type of enterprise. “I had always wanted to use tech as a force for good to build a new type of business looking at the whole well-being of people, physically, emotionally and mentally – to harness all the amazing apps and tech to inspire people to live their best lives.”

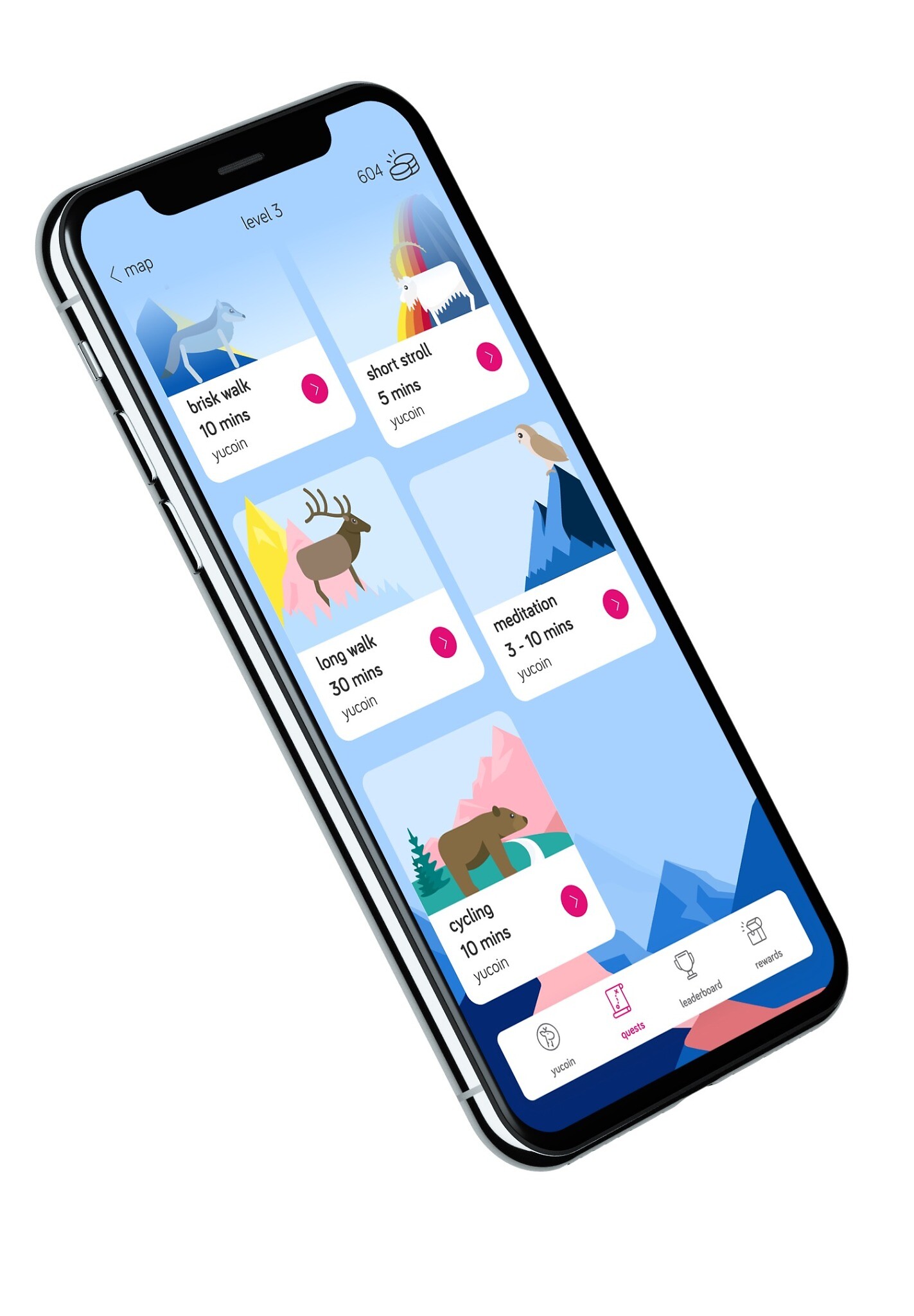

YuLife provides large companies and small and medium-sized enterprises (SME) alike with an end-to-end life digital insurance solution and engages with each member. Through its game-style app, users can earn virtual YuCoins, aka “the currency of well-being” for completing everyday wellness activities, such as walking, meditation, mindfulness and cycling, in return for vouchers and perks from leading brands, including ASOS, Avios, Nike and John Lewis.

Rubin believes it was time to shake up a typically archaic sector. “Life insurance is one of the biggest business areas in the world. It has hardly changed in 200 years, yet our whole lives have changed. The focus has always been on when people die, but, actually, life insurance policies should add value to life. People are living longer and we wanted to create a new model that was more about life than death.

“The Jewish ideal of prioritising life is so important to me, so to be able to build a company that puts life at the centre and bridges my own values means a lot for me.”

Founded in 2016, YuLife has built up an impressive member base and provides life insurance to businesses including the Co-op, market research provider Mintel and credit card consolidation app Curve.

The importance of mental health has been thrust into the spotlight as Covid-19 takes its toll. “It is not taboo in the way it has been,” explains Rubin. “More people are talking about it, accelerated by Covid. Our business has taken off because companies are realising the importance of well-being for their people. And technology is an amazing way people can be rewarded for very simple activities.”

Well-being has become a dealbreaker for staff. “Employees can move from company to company, so firms are looking for ways to increase their benefits. People are demanding better perks and this has been accelerated by Covid. It has changed our priorities as a society – well-being is now an important priority.”

YuLife is backed by father and son duo Robin and Saul Klein, ex-Index Ventures and co-founders of LocalGlobe, as well as FinTech investors Anthemis and Creandum Funds (investors in Spotify).

Rubin believes now is the right time for a new insurance proposition in the UK. “This is just the beginning. Huge enterprises are at long last recognising the importance of well-being, and that their success and productivity is based on their people. It’s about helping their people feel good and giving them the tools to feel empowered to look after themselves.”

The company’s ethos is reflected in its team, largely from outside of the sector and somewhat unconventional for an insurance firm.

YuLife co-founder and COO is part-time Rabbi Sam Fromson, the community rabbi at Golders Green shul, and BBC resident doctor and best-selling author

Dr Rangan Chatterjee is its chief well-being officer.

Rubin is no stranger to the insurance industry. After finishing his computer science degree at Imperial College, he built his first company, Policy Portfolio, from his family’s dining room table. It was a joint project with his father, and four and a half years later they floated it on the London Stock Exchange.

This year, YuLife was a winner at the Financial Services Forum Awards for Product Service and Innovation in Insurance, and was recently named the best London-based start-up to work for by recruitment platform Tempo – something Rubin is particularly proud of – and HR Tech Provider of the Year at the Personnel Today awards.

Workplace well-being and mindfulness have become an essential part of YuLife’s business and Rubin hopes other companies will take note. A recent YouGov-YuLife poll showed that 87 percent of UK office workers are more likely to stay with an employer who demonstrates a commitment to their well-being.

“Enhancing mindfulness in the workplace is mutually beneficial for employers and employees alike. When companies invest in employee well-being, they’ll be rewarded with increased loyalty and retention.

“It’s in businesses’ financial interests to maximise retention and reduce employee churn because, in the long term, there are high costs involved in hiring and replacing employees and onboarding new recruits, not to mention the positive impact induced by higher productivity levels among happier and healthier workers.”

www.yulife.com

Anthony Beilin, Collective Benefits

Within a decade, the number of independent workers could overtake traditional employment. There are about six million self-employed people in the UK – a number that could vastly increase next year – as workers opt for more flexible roles. And the explosion of the gig economy, based on flexible, temporary or freelance jobs where a piece of work is akin to a ‘gig’, highlights this. Think Uber, Deliveroo and Fiverr.

Yet this burgeoning sector has been left exposed, with many workers not receiving the income protections that full-time employees typically do, says Anthony Beilin, a former head of global innovation at Aviva. Today, Beilin is the CEO and co-founder of Collective Benefits, a first-of-its-kind tech platform that aims to give independent workers access to a range of insurance and benefits they otherwise haven’t been getting.

Beilin, 33, says: “We used to talk about six million independent workers in the UK, which includes both higher-paid freelancers and gig economy workers, but by this time next year there could be more than 10 million and I think by 2025 at least half of the working population in the UK, Europe and America will be independent workers.

“Yet there is a growing protection gap being created where independent workers don’t have a safety net; no sick pay, holiday allowance, family leave or mental health support. We are building Collective Benefits to offer protections and benefits to make independent work work for everyone.”

The self-employed are key to getting the economy moving again, but the sector is struggling. According to Collective Benefits data, 96 percent of the nation’s self-employed have no income protection and 93 percent have no health or critical illness cover, and Covid has significantly exacerbated the situation. Many were unable to benefit from the government’s self-employment income support scheme. The World Economic Forum reports that 68 percent of gig workers have had no income during Covid.

“Finding a way to blend the flexibility of working with the basic need of people’s income security is going to be the defining factor of how independent work goes,” says Liverpool-born Beilin, who is now based in north London. “Never has it been more urgent. In fact, I wonder what the role of traditional employment will be in the long-term. The data we are seeing shows there will be a natural evolution of this workforce. We need a new playbook to support that.”

Beilin was inspired to create one after a prolapsed disc in 2018 meant he couldn’t work for six months. He recalls: “My friend, recently self-employed, was also on sick leave. We were discussing how difficult it was for him as he wasn’t being paid or receiving any benefits and was living off his savings. His whole financial existence had radically changed by the fact he had gone from employee to self-employed.

“It was a strange lightbulb moment. I had recognised the shift and, seeing all these things happening, it really struck a chord. Why weren’t all these benefits available?”

Beilin had been working at Aviva and part of his remit was to look at the changing demographics in the workforce, notably the rise in SMEs and independent workers. “It became very apparent that Aviva, despite being the UK’s number one insurer, was woefully underequipped to solve the needs of this changing demographic.”

He teamed up with Benjamin Hay, ex-leadership team at Sir Richard Branson’s Virgin Unite entrepreneurial foundation, and they launched Collective Benefits last year. They raised £3.5m of investment driven by Delin Capital and Stride VC, who between them have financed several high-profile companies such as Zoopla and Deliveroo. They are also backed by other angel investors, including those behind Just Eat and Uber. They partner with organisations that have independent workforces including TaskRabbit, DPDgroup, Gophr and Green Tomato Cars. This month, Collective Benefits won insurer innovation of the year award at the Insurance Times Insurance Awards 2020.

Collective Benefits does not offer protection direct to consumers but plans to do so in the future. In April, it launched a community Covid response package, bringing 200 self-employed individuals onto the platform, providing sick pay and benefits to help them secure their livelihood at a difficult time.

The shift towards a more independent workforce seems inevitable and the pandemic has accelerated this. And it’s not just the usual suspects. There has been an increase in workers not currently significantly gig-based, such as those in white-collar business service industries.

“It’s not just the lower income status we are seeing as independent workers; it’s proliferating across all sectors of the economy – not just the Deliveroos and Ubers. It’s locum doctors, nurses, carers for loved ones, delivery of prescriptions, fulfilment of PPE, taxis, parcel deliveries… It’s an essential demographic.”

Why, then, haven’t insurance companies moved with the times? “They’ve had a product that’s been around for 200 years. This market has gone from around 800,000 people to 15 million and the changing demographic of the independent workforce has completely broken that product. At the best of times, these organisations are slow to move, but this is so notable now. The needs have changed so dramatically and the way to fulfil them needs technology and they have been slow to adopt that technology.”

Beilin believes the government has played its part in supporting independent workers during the pandemic, but says that outside of the immediate emergency, the onus must be on companies. “Flexible working is here to stay and businesses need to change.”

Many already are. Prioritising benefits for workers has become a top agenda for the key players. “The CEO of the combined Just Eat/Takeaway.com group has spoken about the importance of worker safety. And Amazon, which is the focus of a lot of negative press on this, has already started rolling out a programme in the US and Europe, representing their independent workers. Many are committed to putting benefit programmes in place, although they are now regulatory required to, so workers can maintain their flexibility and have the benefits that come with it.”

Thank you for helping to make Jewish News the leading source of news and opinion for the UK Jewish community. Today we're asking for your invaluable help to continue putting our community first in everything we do.

For as little as £5 a month you can help sustain the vital work we do in celebrating and standing up for Jewish life in Britain.

Jewish News holds our community together and keeps us connected. Like a synagogue, it’s where people turn to feel part of something bigger. It also proudly shows the rest of Britain the vibrancy and rich culture of modern Jewish life.

You can make a quick and easy one-off or monthly contribution of £5, £10, £20 or any other sum you’re comfortable with.

100% of your donation will help us continue celebrating our community, in all its dynamic diversity...

Engaging

Being a community platform means so much more than producing a newspaper and website. One of our proudest roles is media partnering with our invaluable charities to amplify the outstanding work they do to help us all.

Celebrating

There’s no shortage of oys in the world but Jewish News takes every opportunity to celebrate the joys too, through projects like Night of Heroes, 40 Under 40 and other compelling countdowns that make the community kvell with pride.

Pioneering

In the first collaboration between media outlets from different faiths, Jewish News worked with British Muslim TV and Church Times to produce a list of young activists leading the way on interfaith understanding.

Campaigning

Royal Mail issued a stamp honouring Holocaust hero Sir Nicholas Winton after a Jewish News campaign attracted more than 100,000 backers. Jewish Newsalso produces special editions of the paper highlighting pressing issues including mental health and Holocaust remembrance.

Easy access

In an age when news is readily accessible, Jewish News provides high-quality content free online and offline, removing any financial barriers to connecting people.

Voice of our community to wider society

The Jewish News team regularly appears on TV, radio and on the pages of the national press to comment on stories about the Jewish community. Easy access to the paper on the streets of London also means Jewish News provides an invaluable window into the community for the country at large.

We hope you agree all this is worth preserving.

-

By Brigit Grant

-

By Laurent Vaughan - Senior Associate (Bishop & Sewell Solicitors)

-

By Laurent Vaughan - Senior Associate (Bishop & Sewell Solicitors)

-

By Laurent Vaughan - Senior Associate (Bishop & Sewell Solicitors)

-

By Laurent Vaughan - Senior Associate (Bishop & Sewell Solicitors)